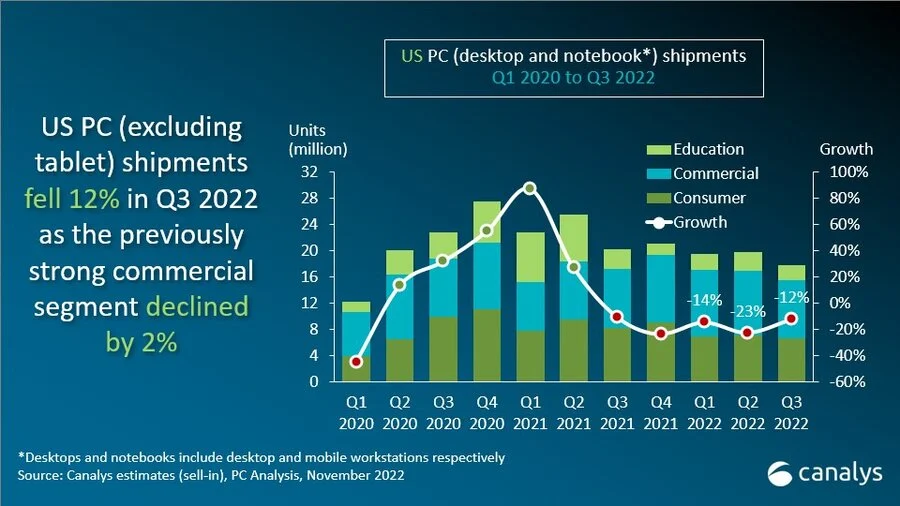

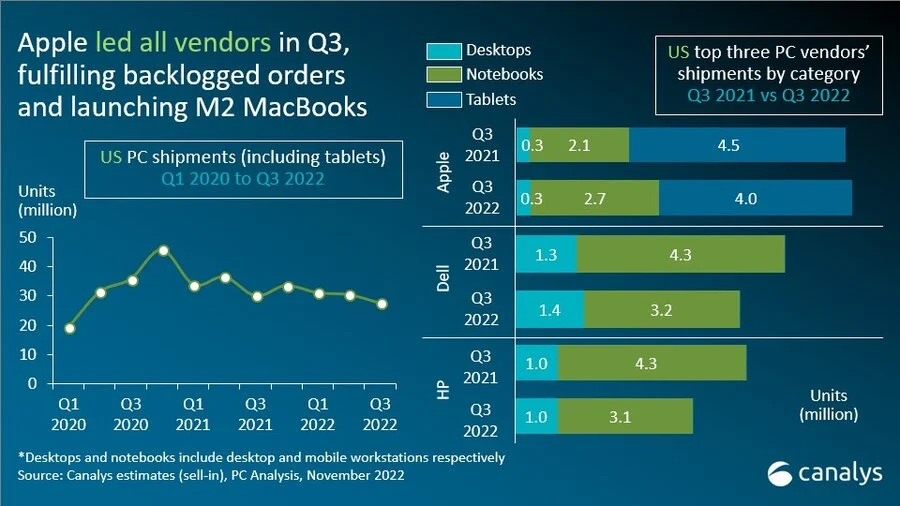

In the third quarter compared to the previous year, Computer exports in the United States decreased by 12.1 percent. The leading producers are Dell, Hewlett Packard, Apple, and Acer; both Apple and Acer experienced significant growth during the time span of these producers. According to Canalys, computers have seen a 1 percent growth while laptops experienced a 14 percent loss. Lower sales from the consumers and academic areas, along with more cautious business expenditures, were the main causes of the dramatic decline in laptop export volume.

The U.S. Personal Computer market growth accelerates to zero, with shipments down 4% quarter-on-quarter and 11% year-on-year. All markets experienced deep contraction. However, commercial device units grew – which had previously been suffering from a severe impact from saturation in the education and consumer segments.

Personal Computer manufacturers struggled mightily in the 3rd period, and the 4th quarter's outlook doesn't appear to be much improved. The American festive season should boost sales a little, but generally, Canalys predicts that now the marketplace will continue to fall. Individuals are reducing back on their purchases of gadgets as a result of rising prices.

Canalys believes that in the next four to five years it will become easier to build new networks in emerging markets. The demand for education will begin retrieving gradually in the upcoming year and Pickings expects changes in product configurations to be more important in determining future shipment volume.

Despite some growth during Q3 2018, the PC market declined slightly from its performance in Q2. Units shipped and revenue was down every year, as expected given the last 6 quarters’ data was also weaker than expected. As can be seen below, sales were off 22% year on year and shipments declined 20% in comparison to Q3 2017. Apple and Acer were the main 2 organizations to experience favorable growth in Q3 during the year. Dell, though, was able to maintain its top position. It had a market position of 26.1 percent, down from 27.6 percent the year back.

Other than stating that there would be "additional challenges," Canalys did not go into much detail regarding future economic growth for PCs. From an economic standpoint, the Fed Reserve is continuing to raise loan rates, which may result in additional mass layoffs and higher mortgage payments, further reducing expendable cash. The duration of the recovery period will determine when customer need for computers will start to increase.

Read next: Microsoft Windows 10 Market Share Dips by 1.5% as Windows 11 Rises

The U.S. Personal Computer market growth accelerates to zero, with shipments down 4% quarter-on-quarter and 11% year-on-year. All markets experienced deep contraction. However, commercial device units grew – which had previously been suffering from a severe impact from saturation in the education and consumer segments.

Personal Computer manufacturers struggled mightily in the 3rd period, and the 4th quarter's outlook doesn't appear to be much improved. The American festive season should boost sales a little, but generally, Canalys predicts that now the marketplace will continue to fall. Individuals are reducing back on their purchases of gadgets as a result of rising prices.

Canalys believes that in the next four to five years it will become easier to build new networks in emerging markets. The demand for education will begin retrieving gradually in the upcoming year and Pickings expects changes in product configurations to be more important in determining future shipment volume.

Despite some growth during Q3 2018, the PC market declined slightly from its performance in Q2. Units shipped and revenue was down every year, as expected given the last 6 quarters’ data was also weaker than expected. As can be seen below, sales were off 22% year on year and shipments declined 20% in comparison to Q3 2017. Apple and Acer were the main 2 organizations to experience favorable growth in Q3 during the year. Dell, though, was able to maintain its top position. It had a market position of 26.1 percent, down from 27.6 percent the year back.

Other than stating that there would be "additional challenges," Canalys did not go into much detail regarding future economic growth for PCs. From an economic standpoint, the Fed Reserve is continuing to raise loan rates, which may result in additional mass layoffs and higher mortgage payments, further reducing expendable cash. The duration of the recovery period will determine when customer need for computers will start to increase.

Read next: Microsoft Windows 10 Market Share Dips by 1.5% as Windows 11 Rises