Remember when we all were kids, and our mothers always used to tell us the importance of saving the money? Imagine a world where a tiny sock falls into your savings pocket whenever you buy a burger, a coffee, or a trendy T-shirt. That, it appears, is the beautiful world of loyalty programs. Businesses trumpet these initiatives, which promise to fill your pockets while you fill your shopping bags. But are they as good as they promise to be? Let's get started and find out!

Hold on to your hats, for a new examination of these loyalty schemes has just revealed the truth about their sock-saving magnificence. While these programs may pique your buying desires, the actual savings may leave you with just one sock - yes, you read that correctly, one sock - after spending a stunning $100.

According to a poll with experts scratching their heads, respondents felt they saved roughly $56 per month through these loyalty programs. But in reality, that's like believing you can fly after seeing a superhero movie - it's not going to happen, buddy. You'd have to spend $2,240 at H&M, $1,200 at Starbucks, or $281 at McDonald's to get your hands on those $56.

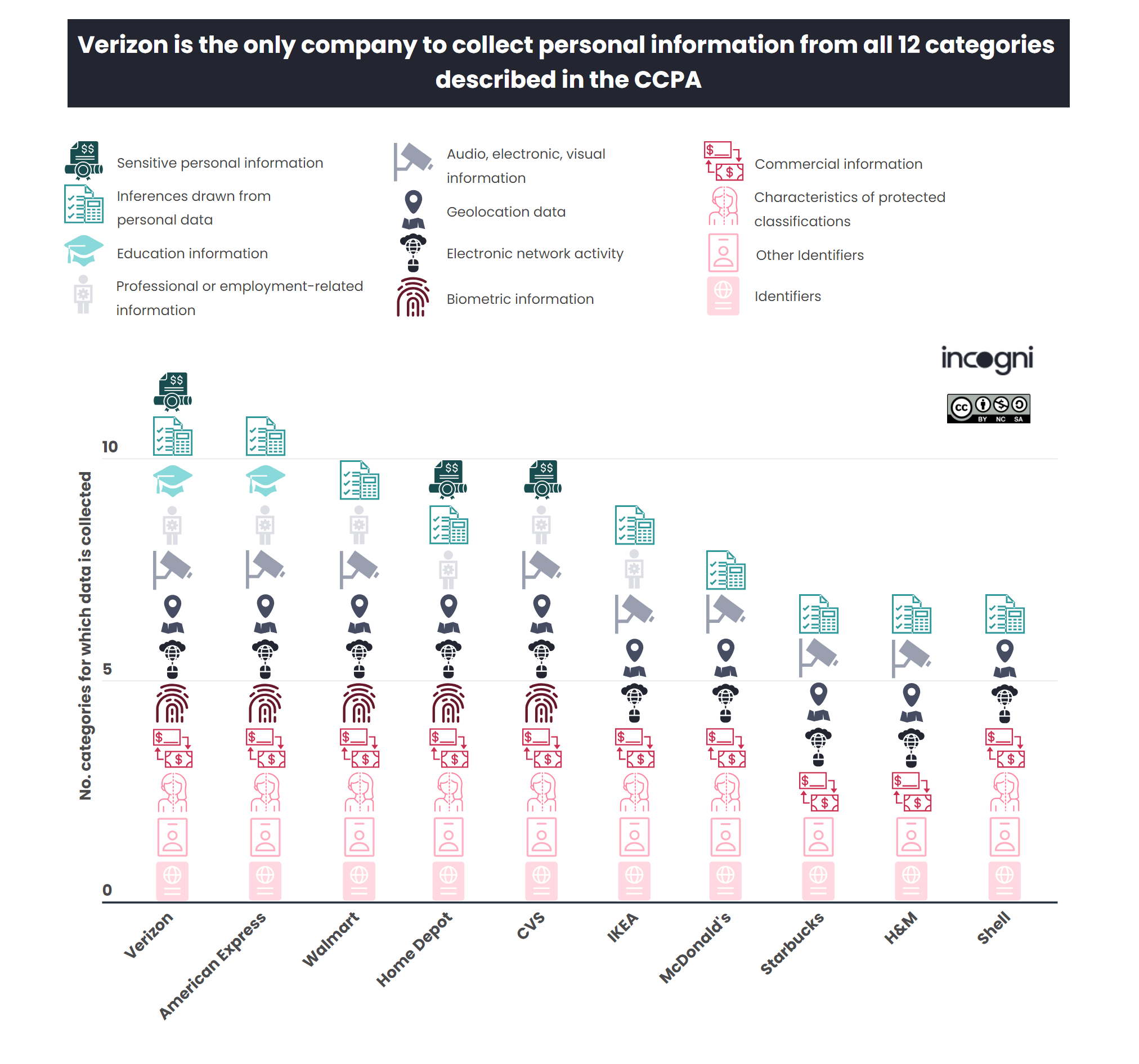

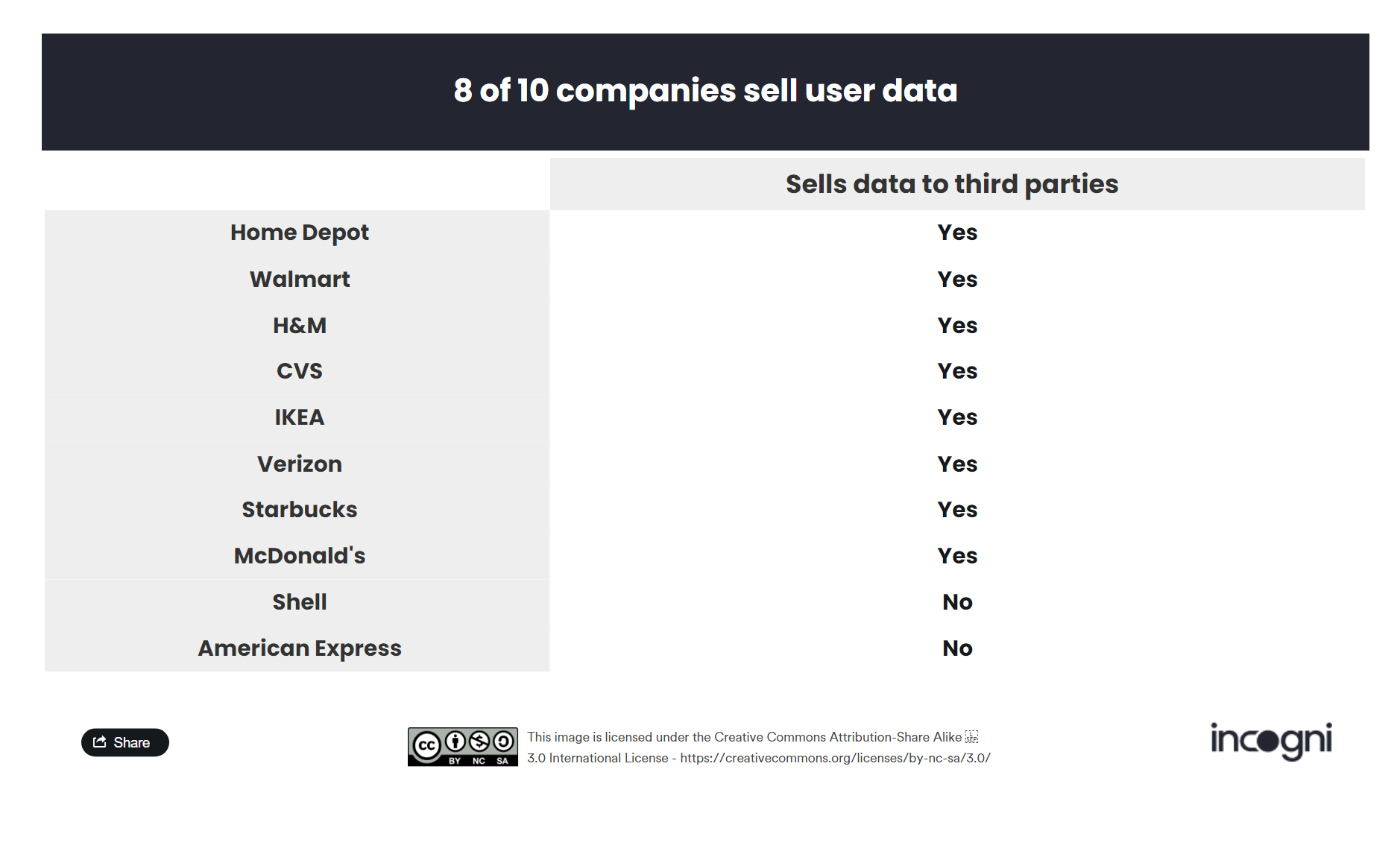

Speaking of pocketing, have you ever thought about how much these programs are pocketed your personal information? Buckle up because data collecting is a rollercoaster out there. Researchers examined the privacy policies of certain significant players and discovered that these individuals keep more data than a dragon guarding its gold. Everything from your favorite hamburger toppings to your political views - and even your fingerprints - is collected. They sell this data treasure trove to the highest bidder, sometimes known as third parties, except for Shell and American Express, which tend to defend their data as if it were the last bit of popcorn at a movie night.

But hold on, there's more! We looked closely at three loyalty kings: Starbucks, McDonald's, and H&M. Starbucks, it turns out, provides the magical potion of four more espresso shots for every $100 you throw their way. It's almost as if you ordered a double shot of espresso only to discover three more in your cup. McDonald's, the cheeseburger king, gives you 6.7 "free" cheeseburgers for every $100 you spend. You are basically putting money aside for a burger party - invite your pals, it'll be a burger feast! Then there's H&M, where you can save $2.50 on every $100 bought. You read that correctly: you can buy a single sock with those savings. What a sock-it-to-me offer!

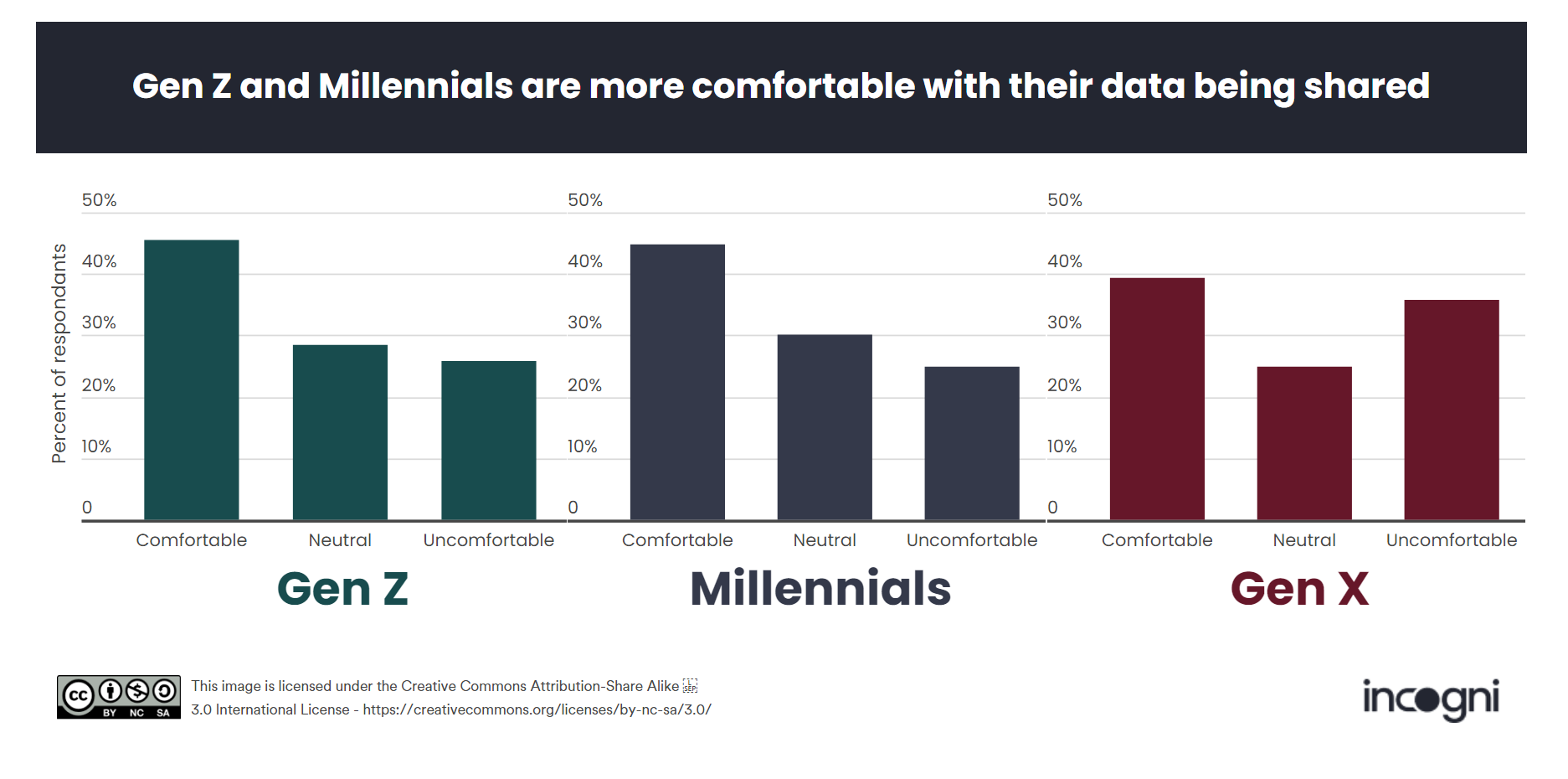

Hold on to your cheeseburgers because, according to the report, 81% of respondents are on board with loyalty programs. Millennials and Generation Z are spearheading the charge, with Gen Xers falling behind. But here's the rub: 38% stick to one or two loyalty schemes, while 43% ride the data-sharing carousel with more than two programs.

So, are these loyalty schemes the ultimate way to save money? Well, not exactly. It's like expecting your pet goldfish to do your homework – a bit of a stretch. Sure, they dangle those freebies like a carrot, but the numbers just don't add up. You may need to befriend a unicorn to properly feel the savings magic. Furthermore, these firms use your data like a hot potato, giving it to third parties like a game of hot potato.

Remember, before you leap into the ocean of loyalty programs, make sure you're prepared to swim alongside data-hungry sharks. It's not all fun and games, and that sock-saving fantasy might be a little delusion. Happy shopping, and may the savings odds ever be in your favor!

H/T: Incogni

Read next: The FTC Has Received Over 500,000 Credit Bureau Fraud Claims in H1 2023 Alone

Hold on to your hats, for a new examination of these loyalty schemes has just revealed the truth about their sock-saving magnificence. While these programs may pique your buying desires, the actual savings may leave you with just one sock - yes, you read that correctly, one sock - after spending a stunning $100.

According to a poll with experts scratching their heads, respondents felt they saved roughly $56 per month through these loyalty programs. But in reality, that's like believing you can fly after seeing a superhero movie - it's not going to happen, buddy. You'd have to spend $2,240 at H&M, $1,200 at Starbucks, or $281 at McDonald's to get your hands on those $56.

Speaking of pocketing, have you ever thought about how much these programs are pocketed your personal information? Buckle up because data collecting is a rollercoaster out there. Researchers examined the privacy policies of certain significant players and discovered that these individuals keep more data than a dragon guarding its gold. Everything from your favorite hamburger toppings to your political views - and even your fingerprints - is collected. They sell this data treasure trove to the highest bidder, sometimes known as third parties, except for Shell and American Express, which tend to defend their data as if it were the last bit of popcorn at a movie night.

But hold on, there's more! We looked closely at three loyalty kings: Starbucks, McDonald's, and H&M. Starbucks, it turns out, provides the magical potion of four more espresso shots for every $100 you throw their way. It's almost as if you ordered a double shot of espresso only to discover three more in your cup. McDonald's, the cheeseburger king, gives you 6.7 "free" cheeseburgers for every $100 you spend. You are basically putting money aside for a burger party - invite your pals, it'll be a burger feast! Then there's H&M, where you can save $2.50 on every $100 bought. You read that correctly: you can buy a single sock with those savings. What a sock-it-to-me offer!

Hold on to your cheeseburgers because, according to the report, 81% of respondents are on board with loyalty programs. Millennials and Generation Z are spearheading the charge, with Gen Xers falling behind. But here's the rub: 38% stick to one or two loyalty schemes, while 43% ride the data-sharing carousel with more than two programs.

So, are these loyalty schemes the ultimate way to save money? Well, not exactly. It's like expecting your pet goldfish to do your homework – a bit of a stretch. Sure, they dangle those freebies like a carrot, but the numbers just don't add up. You may need to befriend a unicorn to properly feel the savings magic. Furthermore, these firms use your data like a hot potato, giving it to third parties like a game of hot potato.

Remember, before you leap into the ocean of loyalty programs, make sure you're prepared to swim alongside data-hungry sharks. It's not all fun and games, and that sock-saving fantasy might be a little delusion. Happy shopping, and may the savings odds ever be in your favor!

H/T: Incogni

Read next: The FTC Has Received Over 500,000 Credit Bureau Fraud Claims in H1 2023 Alone