Meta has recently published its Q3 earnings report and there are some interesting findings worth a mention.

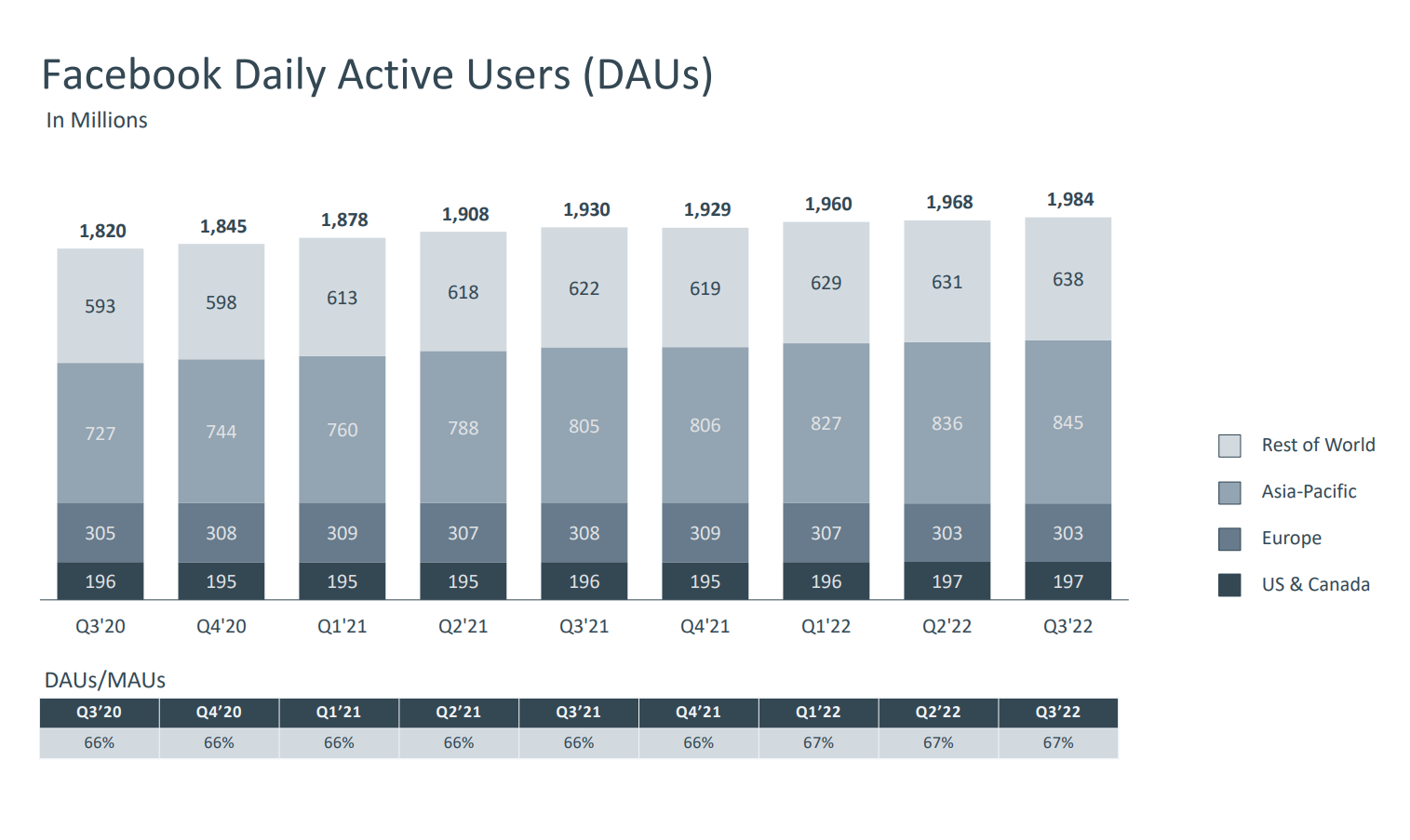

For starters, Facebook improved and was up by nearly 1.98 billion users on a daily basis and that’s a 16 million growth from what was seen in Q2. But most of the growth seems to arise from the region of the Asia-Pacific and not from areas like the US and Europe. The latter are two places where it is having trouble making its mark.

A lot of growth and positivity arose in Indonesia and in India, thanks to connectivity and great accessibility taking place in this area. Still, it’s not a whole lot of contribution than other established markets where DAU is deemed to be dead as it’s a huge concern for the platform.

Meanwhile, the active user count on a monthly basis is seeing a similar picture. Here, a lot of the growth is again coming from outside the UK and US, and other leading parts of Europe. But we have to give credit to the app as more and more people are logging in and making the active user count 3 billion.

This is proof of how Meta’s famous apps are still very active and popular with different users across the board.

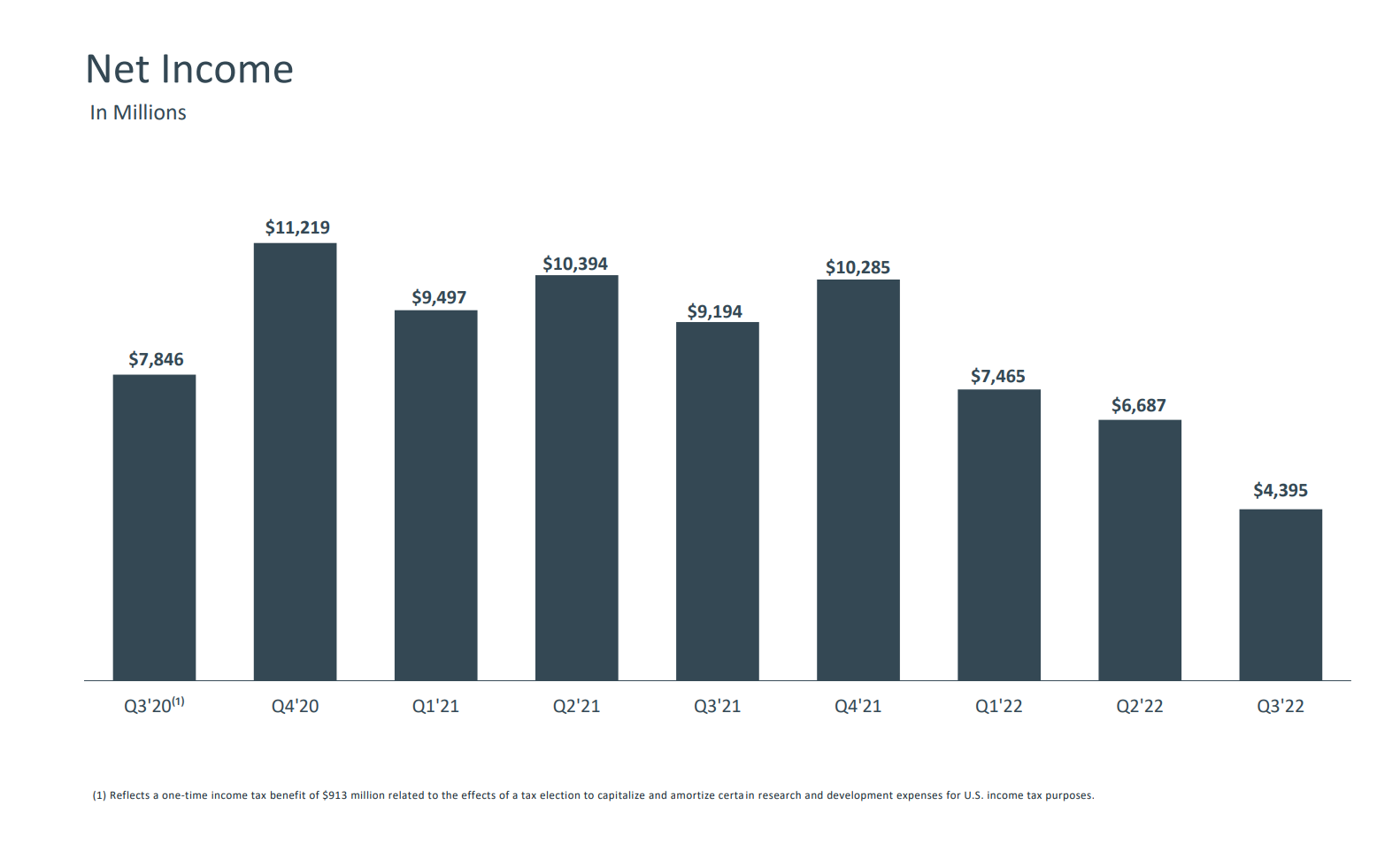

But the major concern has to do with Meta’s current revenue figures. The firm brought in a staggering $27 billion in Q3 and that’s a huge number but still, it’s a fall from the 4% seen YoY.

This reduced figure had to do with the fact that some of it may be linked to shifts in data privacy and the role of the current economic downturn is also occurring. As Meta says, if the current exchange rate for foreign currency was higher, figures would be nearly $1 billion higher.

So as you can see, several different factors are responsible for this and not just one factor. This as a whole, is having a major impact that’s not too great for Meta who wants to make huge investments in the metaverse. This has resulted in a rise in its expenditure and costs by 19% to $22 billion.

But another point of great concern is the Reality Labs. This VR department is the largest cost center and is bringing forward a small chunk of revenue with time. VR prices for headsets are at an all-time high and less interest in the metaverse has caused it to fall in terms of both sales and revenue.

Meta has mentioned how losses will also occur in 2023 for its Reality Labs but after that, their investments in this feature can assist in gaining the goal of more company income in the future to better stabilize the situation.

But if you ask tech experts, things are not looking too good. The push for the upcoming metaverse is giving rise to more development before attaining the next era of the project.

So as you can see, Meta has a huge challenge in front of it and so does the CEO who has literally lost his firm’s two third value since the figures seen last year. And with his very enthusiastic stance on the metaverse that most people are failing to see eye-to-eye with, it’s a major challenge.

And the struggle continues with ads as Apple’s ATT policy linked to data tracking will cost the firm $10 billion so as you can see, a lot of things are surrounding the matter. So the real question now arises of what’s next and can investors and the company be able to pull through ten more years of pain before reaching the next stage of the metaverse.

Read next: Meta Wants To Assist Brands In Protecting Their Intellectual Property Through Its Apps

For starters, Facebook improved and was up by nearly 1.98 billion users on a daily basis and that’s a 16 million growth from what was seen in Q2. But most of the growth seems to arise from the region of the Asia-Pacific and not from areas like the US and Europe. The latter are two places where it is having trouble making its mark.

A lot of growth and positivity arose in Indonesia and in India, thanks to connectivity and great accessibility taking place in this area. Still, it’s not a whole lot of contribution than other established markets where DAU is deemed to be dead as it’s a huge concern for the platform.

Meanwhile, the active user count on a monthly basis is seeing a similar picture. Here, a lot of the growth is again coming from outside the UK and US, and other leading parts of Europe. But we have to give credit to the app as more and more people are logging in and making the active user count 3 billion.

This is proof of how Meta’s famous apps are still very active and popular with different users across the board.

But the major concern has to do with Meta’s current revenue figures. The firm brought in a staggering $27 billion in Q3 and that’s a huge number but still, it’s a fall from the 4% seen YoY.

This reduced figure had to do with the fact that some of it may be linked to shifts in data privacy and the role of the current economic downturn is also occurring. As Meta says, if the current exchange rate for foreign currency was higher, figures would be nearly $1 billion higher.

So as you can see, several different factors are responsible for this and not just one factor. This as a whole, is having a major impact that’s not too great for Meta who wants to make huge investments in the metaverse. This has resulted in a rise in its expenditure and costs by 19% to $22 billion.

But another point of great concern is the Reality Labs. This VR department is the largest cost center and is bringing forward a small chunk of revenue with time. VR prices for headsets are at an all-time high and less interest in the metaverse has caused it to fall in terms of both sales and revenue.

Meta has mentioned how losses will also occur in 2023 for its Reality Labs but after that, their investments in this feature can assist in gaining the goal of more company income in the future to better stabilize the situation.

But if you ask tech experts, things are not looking too good. The push for the upcoming metaverse is giving rise to more development before attaining the next era of the project.

So as you can see, Meta has a huge challenge in front of it and so does the CEO who has literally lost his firm’s two third value since the figures seen last year. And with his very enthusiastic stance on the metaverse that most people are failing to see eye-to-eye with, it’s a major challenge.

And the struggle continues with ads as Apple’s ATT policy linked to data tracking will cost the firm $10 billion so as you can see, a lot of things are surrounding the matter. So the real question now arises of what’s next and can investors and the company be able to pull through ten more years of pain before reaching the next stage of the metaverse.

Read next: Meta Wants To Assist Brands In Protecting Their Intellectual Property Through Its Apps