A market in motion: fragmentation, not fatigue

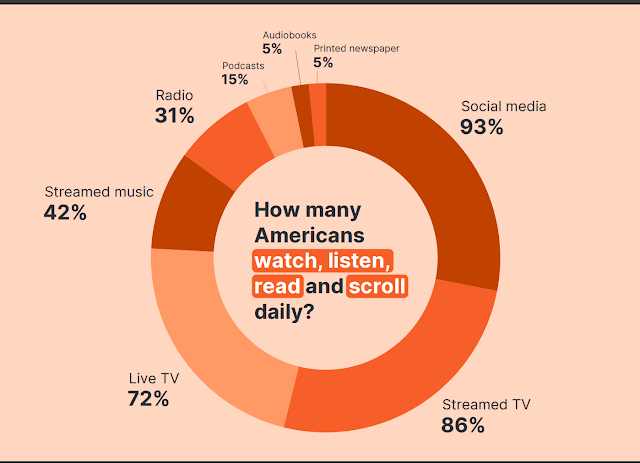

One of the most important takeaways from this year’s report is that media consumption isn't declining - it's dispersing. Americans are still watching, listening, and scrolling at high rates, but where they’re spending their time (and how much of it) is changing.

- 93% of US consumers use social media daily.

- 86% stream TV.

- 42% stream music.

- Only 5% read a printed newspaper daily.

These top-line figures highlight the obvious dominance of digital formats - but they mask the more complex trend underneath: shifting patterns within digital media. Let’s unpack that…

Social detox meets platform consolidation

Social media is still ubiquitous, but we’re seeing a digital detox trend - especially among Millennials and older Gen Zs. The number of Americans spending more than 3 hours a day on social platforms has dropped to 30%, down -6.5 percentage points from last year. Among 31–49s, long social sessions are down -10.5 points, while under-30s have cut back by -7 points (though 46% of them still spend more than three hours daily).

This drop in volume has major implications for content fatigue and engagement strategies. Brands chasing reach alone will increasingly miss the mark if they’re not matching creative to platform and mood.

So who’s bucking the trend? TikTok, of course. It’s the only social platform to gain daily users this year, rising +5 points to 30% overall, and up a massive +12 points among 18–30s, where it now matches Instagram in popularity. Meanwhile, Facebook and X (formerly Twitter) lost ground, especially with 31–49s.

Also notable: YouTube has quietly become the most-used platform overall, with 71% of Americans using it at least three times a week.

Implication for strategists: prioritize TikTok for under-30 reach, YouTube for universal scale, and re-evaluate investment in declining platforms like X, where 54% of Americans now report never using it (a figure that’s climbed +11 points in two years).

Streaming splinters, but Prime climbs

Streaming TV remains strong but less sticky. Fewer people are binge-watching: those watching 3+ hours daily dropped from 61% to 56%. At the same time, 33% now stream for just 1–2 hours per day - a growing segment that suggests more selective engagement.

When it comes to platforms:

- Netflix still leads with 64% of Americans using it at least once a week.

- Amazon Prime surged +4 points to 49% - its highest ever.

- Disney+ also climbed +4 points to 35%, though still shy of its 2023 peak.

Max and Apple TV continue to falter (Max down to 25%, Apple stuck at 12%). Viewing also diverges by age: Netflix, Hulu, and Disney+ are Gen Z favorites, while Prime and YouTube TV over-index with Millennials and Gen X.

With advertising opportunities on streaming platforms increasing, and consumers willing to tolerate up to four ads per show , streamers should certainly be part of the advertising mix. But detailed research to understand what your target audience is watching, where, and when, will be necessary.

Audio audiences: younger, older - or both?

Audio is another space in flux, where age divergence is creating distinct listener profiles.

- Spotify leads music streaming with 39% of Americans using it regularly (+3 points), thanks to 56.5% of under-30s tuning in.

- YouTube Music trails at 31%, down -7 points, now dominated by the 31-49 age group.

- Amazon Music continues to slide, now tied with Apple Music at 19%.

Meanwhile, traditional radio is slowly fading, with daily listenership down to 31%, from 37% in 2023. Yet, among older and higher-income demographics, it remains resilient: 60% of households earning $100K+ still listen multiple times per week.

The podcast space offers a twist: usage is actually growing among over-50s (+5 points), while dipping among under-30s (down -7 points). Today, 32% of older Americans stream podcasts weekly - mostly news and political content - while younger listeners lean toward comedy and true crime.

Digital news dominates, but youth tune out

Only 5% of Americans read a printed newspaper daily. Half (48%) never read them at all. This year marks a new low, driven largely by over-50s abandoning a format they once propped up. Even among those aged 31–49 - the most engaged print demographic - only 8% read daily.

Digital content is stronger, but not growing. Weekly digital news access sits at 54%, while digital magazines attract 24% of Americans each week. However, under-30s are turning away from both:

- Weekly digital news access among 18–30s dropped -7.5 points to 41.5%.

- Digital magazine readership fell -10.5 points to 20.5%.

This is likely due to substitution. Younger users are increasingly getting news via social feeds - especially TikTok and Instagram. Combine that with subscription fatigue, and the challenge for publishers becomes clear.

Interestingly, content subscription rates remain relatively stable: 34% of Americans pay for some form of news or magazine content. But the under-30s - historically big spenders - are cutting back. Their subscription rate dropped -11.5 points this year, with noticeable declines in those holding both digital and print subs.

The platform playbook for 2025

So, what do 2025’s media usage trends mean for digital marketers, platform strategists, and content teams? Most importantly, digital professionals must stop chasing the biggest audiences and start understanding the right ones.

Ruthless segmentation should be at the heart of any strategy. Audiences are diverging in how they consume content - not just by age, but by income, gender, and even mood. And with growing platform saturation, it’s also important to crack cross-platform behavior.

Imagine showing your target consumer a video ad on Prime, followed by DSP on Facebook, and then serving an audio ad on their favorite podcast to seal the deal. The more you know about your audience and the media that makes up their daily routine, the more successful your campaigns will be.

Methodology note:

All figures within this article are taken from research conducted on the Attest platform. The total sample size for the2025US Media Consumption Report was 1,000 nationally representative working-age consumers based in the United States. The survey concluded on April 22025. The full report can be found here and the research dashboard is available here.

Written by Nick White, Head of Strategic Research, Attest.

Read next: The Business of You: How Digital Platforms Turn Your Life into Ad Revenue