It's no novelty that fraudsters pose a threat to senior citizens living in the US, as reports show they are increasingly vulnerable to new cybercrimes, especially those involving AI-powered phishing scams and spoofing attacks. Despite improvements in digital safety education among the elderly, their limited data security knowledge (and hard-earned financial savings) make them easy targets for criminals exploiting personal information.

As a result, in 2024, the number of complaints and total losses reported to the FBI's Internet Crime Complaint Center (IC3) were the highest they've ever been. The number of victims increased by 45% to a staggering 147 thousand people. Also, the total financial losses grew by 43% compared to last year to almost $4.9 billion in 2024. Only between 2019 and 2024, nearly $15B has been reported lost, with over 600,000 victims reporting a cybercrime to the FBI.

Fraudsters tend to target older adults because they believe they have more to lose. They are also assumed to take longer to notice a scam attempt until it’s too late. Senior age groups have also demonstrated that they are often too embarrassed to report a scam after it has occurred. Criminals, therefore, consider this demographic "low-risk." Meanwhile, a successful scam can be devastating for older adults, whose ability to recover their losses is limited.

To understand the direct connection between widespread data exposure and rising cybercrime rates among seniors, Incogni's research team conducted an in-depth analysis of elder fraud incidents using FBI Internet Crime Complaint Center (IC3) statistics, showing patterns that demonstrate how exposed personal data fuels targeted scams.

Out of the 113,906 crimes involving elders reported in 2024, they identified that 72% of cases were enabled by the availability of victims' personal information online. Crimes facilitated by access to data were associated with $4.2B in losses, accounting for 86% of total losses.

When we think of personal information that fraudsters might easily find, the first thing that comes to our minds might be our email address or a phone number that criminals might just use as bait (to send a malicious link to extort more data) or in a phishing attempt to try to convince a victim into revealing login details or passwords for different services, including banking accounts.

But there are even easier ways to uncover this personal data. A Google Search, a ChatGPT search, or a people-site search exposes all this data and much more. In just two clicks (one for entering personal details, and one to hit search), they can uncover details on our living situation, the value of our house, our family members, and the value of our assets. By paying deeper into data brokers' pockets, they might also find out what our health condition is and learn our daily habits and locations we often visit. Combined with any public social media information, this tactic becomes the perfect source of information for malicious actors while searching for potential victims.

“When looking at Incogni’s research stats, at least some of these cybercrimes are very preventable. In some cases, the losses can at least be mitigated quite a bit. It all comes down to personal data online that is easily accessible by different parties, including fraudsters, underlines Darius Belejevas, Head of Incogni, a data protection company.”

Incogni's researchers identified 11 crime categories from the FBI report that may be made possible or made worse if the criminals have access to the information held and sold by data brokers.

Similarly to last year, in 2024, investment scams were the most costly for victims, with total losses amounting to $1.83B, or $194,100 per complaint. These were followed by business email compromises (BECs), associated with an average loss of $116,700 per complaint, and data breaches responsible for average losses of around $95,200 per report. Phishing and spoofing dominated the cybercrime landscape, with 23.3K cases reported, which is seven times more than last year.

These two last crimes constituted 20% of all crimes reported, while in the previous year, the most reported crimes were tech-support scams, at 17.7K times, comprising 18.5% of all reported crimes. Compared to 2022, the most popular crime, tech-support scams, again constituted 18% of all crimes reported. This suggests a slow shift towards a select few techniques used by criminals and others who victimize elders.

Overall, in 2024, victims of elder fraud in Texas suffered the greatest average losses per complaint—$51.7K—followed by those in Georgia and California, where reported losses per complaint averaged over $48.2K and $46K, respectively.

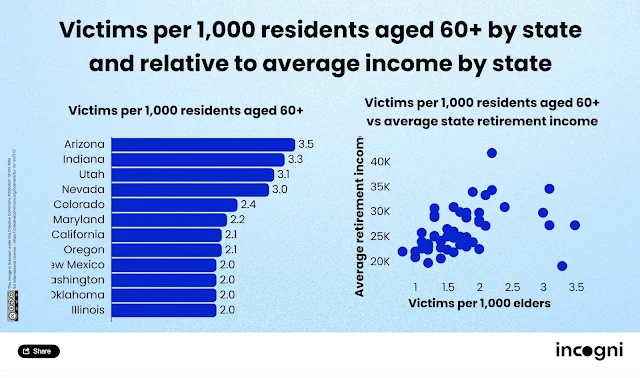

Incogni researchers also cross-checked the total number of complaints versus the population of individuals aged 60+ years for each state to understand better the ratios of elders living in each state to those affected.

Across the US, around 1.8 complaints were filed per 1,000 American residents aged 60 years or older, while some states stood out regarding the number of elders affected per senior population.

The highest number of complaints among states was seen among Arizona's older residents, who reported 3.5 complaints for every 1,000 elders. Indiana, Utah, and Nevada followed, with three or more complaints per 1,000 residents aged 60+ years.

Incogni's researchers also found a statistically significant correlation between the average retirement income in each state and the number of complaints per 1,000 elders in that state, proving that older populations living in wealthier states are more likely to be victims of cybercrime.

“It's absolutely critical that we defend our seniors from these devastating frauds and scams targeting them based on the personal information available online,–added Belejevas. "However, to create more coordinated efforts to shield elderly Americans from the wave of cybercrimes, we need policymakers, companies, and citizens to work together."

Incogni's researchers examined the 2024 Internet Crime Report, published by the Internet Crime Complaint Center (IC3), a division of the FBI.

Full analysis , including the public dataset, can be found here.

Read next: Nearly Half Of Americans, Particularly Millennials, Worry About Online Privacy But Continue Using Data-hungry Apps