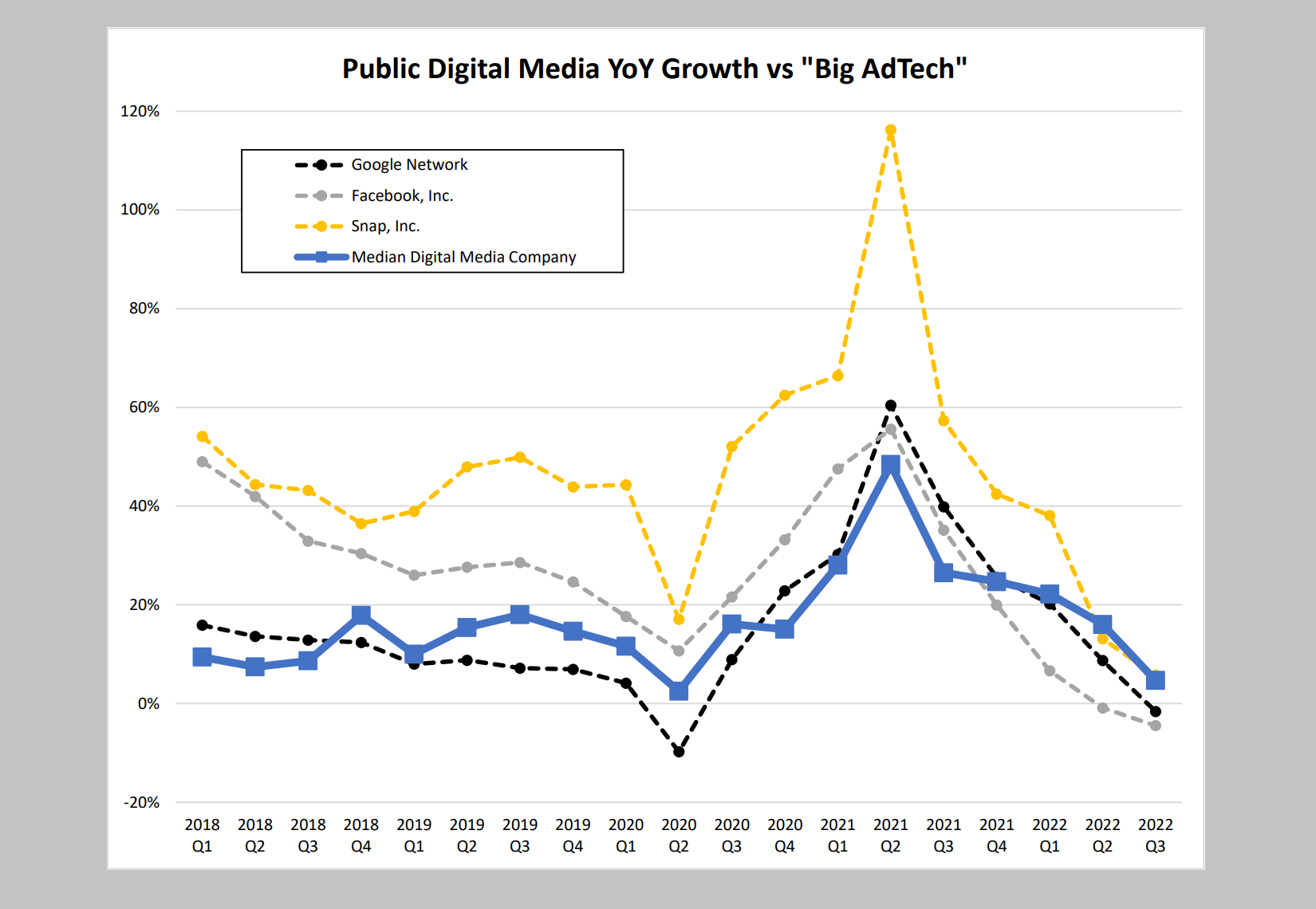

As per the 2022 Q3 report issued by OAREX, digital media income has decreased for publicly traded US companies in the third quarter of 2022, which was higher in the second quarter.

As we speak, Meta has seen a 4% fall in its year-on-year revenue, Google Networks has declined by 2% but Snap has seen an increase of 6%.

Moving towards MediaAlpha, a drop of a massive 42% has been recorded in its YOY revenue. But that’s not the case with every company, as a considerable amount of growth in revenues has been noted for IAC/Interactive, Zeta Global, Perion Network, Integral Ad Science, The Trade Desk, Hubspot and DoubleVerify are among the companies that have experienced more than 25% growth in their revenues during Q3.

According to Nick Carrabbia, Executive Vice President at OAREX, he said that current trend as depicted by the report shows that revenues are lowering down and late payments are increasing and that is concerning. He continued by saying that this Q3 report has opposed the previous revenue reports that showed a rise in revenues and thus confirmed the idea of a true slowdown. He also suggested that companies should consider this report as they decide their objectives for 2023.

To make sure that report does not contain any bias in its graphs and reflects the true performance of a particular sector, Tech giants like Google, Meta, and Snap are not included in its analysis and have been discussed separately. In the separate discussion for the above-said companies, it was found that they are performing the same and have the same dip in their graphs just like the other companies in the report. Although Twitter is a private company now, the dip in its revenue is visible as well. Unlike Google Networks, an increase of 6% has been recorded for Google Inc.

The OAREX Revenue Report for Q3 2022 also consolidated the fact that bigger is better, so the bigger a company is, the more revenue it will generate.

Speaking about the companies that faced a downfall of more than 10%, included Criteo (-12%), Telaria (-19%), and Marin Software (-19%) as well.

This report is a part of OAREX’s quarterly digital media revenue analysis series. OAREX, which stands for Online Revenue Ad Exchange and works on exchanging digital revenues for digital media-based companies to exchange future revenue pay-outs over currently generated capital.

Read next: New Report Unravels The Biggest Trends Of Brands On Instagram And TikTok

As we speak, Meta has seen a 4% fall in its year-on-year revenue, Google Networks has declined by 2% but Snap has seen an increase of 6%.

Moving towards MediaAlpha, a drop of a massive 42% has been recorded in its YOY revenue. But that’s not the case with every company, as a considerable amount of growth in revenues has been noted for IAC/Interactive, Zeta Global, Perion Network, Integral Ad Science, The Trade Desk, Hubspot and DoubleVerify are among the companies that have experienced more than 25% growth in their revenues during Q3.

According to Nick Carrabbia, Executive Vice President at OAREX, he said that current trend as depicted by the report shows that revenues are lowering down and late payments are increasing and that is concerning. He continued by saying that this Q3 report has opposed the previous revenue reports that showed a rise in revenues and thus confirmed the idea of a true slowdown. He also suggested that companies should consider this report as they decide their objectives for 2023.

To make sure that report does not contain any bias in its graphs and reflects the true performance of a particular sector, Tech giants like Google, Meta, and Snap are not included in its analysis and have been discussed separately. In the separate discussion for the above-said companies, it was found that they are performing the same and have the same dip in their graphs just like the other companies in the report. Although Twitter is a private company now, the dip in its revenue is visible as well. Unlike Google Networks, an increase of 6% has been recorded for Google Inc.

The OAREX Revenue Report for Q3 2022 also consolidated the fact that bigger is better, so the bigger a company is, the more revenue it will generate.

Speaking about the companies that faced a downfall of more than 10%, included Criteo (-12%), Telaria (-19%), and Marin Software (-19%) as well.

This report is a part of OAREX’s quarterly digital media revenue analysis series. OAREX, which stands for Online Revenue Ad Exchange and works on exchanging digital revenues for digital media-based companies to exchange future revenue pay-outs over currently generated capital.

Read next: New Report Unravels The Biggest Trends Of Brands On Instagram And TikTok