The pressure has never been greater on businesses to make it safer for people to pay for goods and services online. First, there’s a pending end-of-year deadline for merchants who do business in the European Economic Area (EEA) to implement “strong customer authentication” (SCA). Second, the COVID-19 pandemic has increased e-commerce to record levels, and along with it, an unprecedented spike in fraud, according to the Federal Bureau of Investigation.

On top of those pressures, businesses are struggling to re-open or deal with peak volumes of business from the pandemic. In April, the Financial Conduct Authority delayed the implementation of SCA until September 2021 for UK businesses to help “minimize potential disruption to consumers and merchants.” But the clock is still counting down for EU merchants. Even though payment service providers Visa and Mastercard requested more time to implement SCA, the European Banking Authority (EBA) is holding fast to its December 31, 2020 deadline. So, despite it all, EU merchants must focus on fraud prevention.

The EU Payments Services Director (PSD2) was issued in 2018 to fight global e-commerce fraud. The global cost of cybercrime is expected to hit $6 trillion in 2021, up from $3 trillion in 2015, according to the Erjavec Group’s Annual Cybercrime Report.

The strong customer authentication is expected to boost security by requiring two-step authentication such as a password, pin number or fingerprint.

The EBA expects the SCA will benefit merchants in the long run as they see higher approval rates and less fraud. In the past, most declined online card payments have been for insufficient funds, invalid card details and expired cards.

Many shoppers, forced online during the pandemic, are now accustomed to the higher security, and studies show they expect it in the future as they continue online shopping even after life returns to normal.

The rules of credit card processing affect any merchant doing business in the European Economic Area (EEA). The EEA consists of all 28 member companies of the European Union as well as the three EEA EFTA Countries: Iceland, Liechtenstein and Norway.

Something only the customer knows such as passwords and pins

Something the customer owns like a mobile phone, wearable device, smart card, token or device

Something the customer has such as a fingerprint, facial feature, voice pattern, iris format, DNA.

Red Maple™ is helping merchants meet the new SCA requirements with StagedPay™. StagedPay is Red Maple’s revolutionary, cloud-based solution for merchants processing Card Not Present (CNP) transactions. StagedPay provides merchants with a system that complies with Strong Customer Authentication by using an email or phone number as a means of verifying identity for credit card transactions and enhancing credit card security.

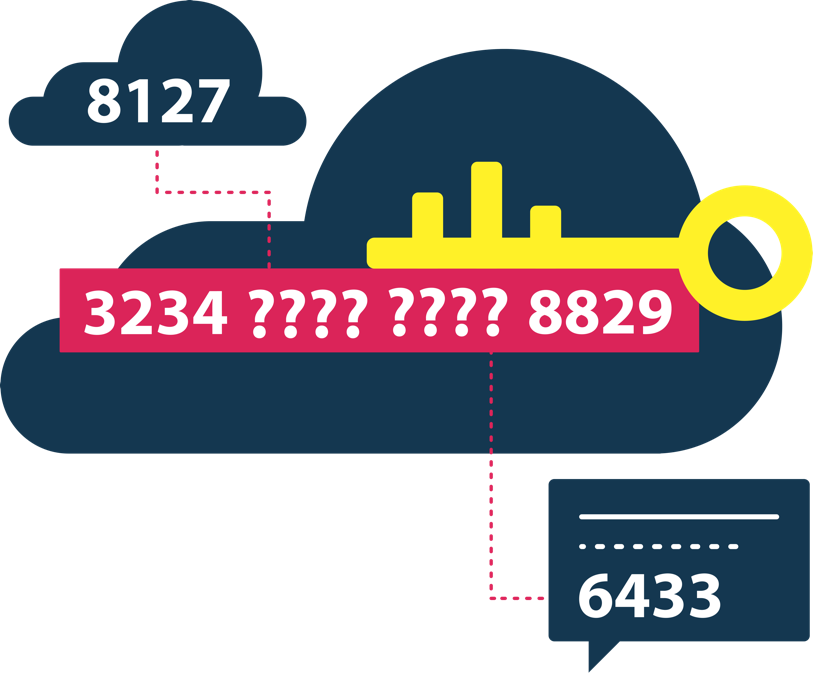

Two-Factor Card Entry. StagedPay provides a patent-pending method of tokenizing card holder information via two-factor entry. Merchants collect part of the card number while allowing the card holder to enter the remaining credit card numbers in a secured portal in the cloud. Customers enter the first part of the credit card number on the website or via telephone when ordering from a live representative. They can then enter the rest of the numbers via text, email, or phone call.

Secured Cloud-Based Portal. StagedPay also provides merchants with a white label, secured portal for their customers to manage their methods of payment (cards, wallets and bank accounts) while also providing merchants the ability to upload invoices for payment.

The software also provides merchants with a drastic reduction in PCI scope.

Here are more features and benefits:

On top of those pressures, businesses are struggling to re-open or deal with peak volumes of business from the pandemic. In April, the Financial Conduct Authority delayed the implementation of SCA until September 2021 for UK businesses to help “minimize potential disruption to consumers and merchants.” But the clock is still counting down for EU merchants. Even though payment service providers Visa and Mastercard requested more time to implement SCA, the European Banking Authority (EBA) is holding fast to its December 31, 2020 deadline. So, despite it all, EU merchants must focus on fraud prevention.

The EU Payments Services Director (PSD2) was issued in 2018 to fight global e-commerce fraud. The global cost of cybercrime is expected to hit $6 trillion in 2021, up from $3 trillion in 2015, according to the Erjavec Group’s Annual Cybercrime Report.

The strong customer authentication is expected to boost security by requiring two-step authentication such as a password, pin number or fingerprint.

The EBA expects the SCA will benefit merchants in the long run as they see higher approval rates and less fraud. In the past, most declined online card payments have been for insufficient funds, invalid card details and expired cards.

Many shoppers, forced online during the pandemic, are now accustomed to the higher security, and studies show they expect it in the future as they continue online shopping even after life returns to normal.

The rules of credit card processing affect any merchant doing business in the European Economic Area (EEA). The EEA consists of all 28 member companies of the European Union as well as the three EEA EFTA Countries: Iceland, Liechtenstein and Norway.

HOW THE SCA WORKS

Specifically, the regulations require strong customer authentication when someone:- Accesses payment accounts online

- Initiates any electronic payment transaction

- Carries out an action through a remote channel which may imply a risk of fraud

Something only the customer knows such as passwords and pins

Something the customer owns like a mobile phone, wearable device, smart card, token or device

Something the customer has such as a fingerprint, facial feature, voice pattern, iris format, DNA.

Red Maple™ is helping merchants meet the new SCA requirements with StagedPay™. StagedPay is Red Maple’s revolutionary, cloud-based solution for merchants processing Card Not Present (CNP) transactions. StagedPay provides merchants with a system that complies with Strong Customer Authentication by using an email or phone number as a means of verifying identity for credit card transactions and enhancing credit card security.

Two-Factor Card Entry. StagedPay provides a patent-pending method of tokenizing card holder information via two-factor entry. Merchants collect part of the card number while allowing the card holder to enter the remaining credit card numbers in a secured portal in the cloud. Customers enter the first part of the credit card number on the website or via telephone when ordering from a live representative. They can then enter the rest of the numbers via text, email, or phone call.

Secured Cloud-Based Portal. StagedPay also provides merchants with a white label, secured portal for their customers to manage their methods of payment (cards, wallets and bank accounts) while also providing merchants the ability to upload invoices for payment.

The software also provides merchants with a drastic reduction in PCI scope.

Here are more features and benefits:

- eCommerce Applications

- Customer Engagement Applications

- Back Office Systems

- Mobile Applications

- Retail Applications

- Robust API for Integration